Our solutions serve the following markets

Defence & Security

Our group designs and manufactures leading RF and microwave related equipment for the global defence, homeland security and policing markets, supporting international communication, electronic warfare and sensing system houses and semi- and governmental organizations tasked with keeping our lives and livelihoods safe and secure. Our solutions help to provide insights on how the radio spectrum is utilized to effectively help enforce compliance and prevent abuse of this valuable resource. Our fixed, mobile and portable radio direction finding antenna systems are best in class for detection and location.

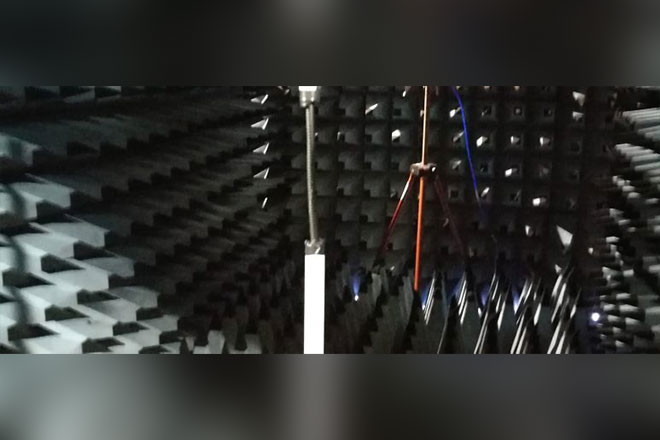

Test & Measurement

Our products support advanced RF and microwave test and measurement requirements, supplemented by decades of experience in the field of electromagnetic measurement and modelling, using advanced simulation tools and sophisticated computational resources.

Science & Exploration

We design and manufacture standard and custom antenna and related RF/microwave electronics products that are used by academia and research organizations to explore the unseen, learn more about our world and develop exciting new enabling technologies.

Telecommunications

Our teams deliver some of the most hardy, robust and reliable RF solutions in the world, designed to work in some of the world's harshest and most unforgiving environments. Our products serve specialized telecommunications needs and help connect people an infrastructure, whether they are perched on the edge of a snowy mountain peak, held aloft at 39000 ft, or baking in the hottest deserts.

Industrial

The Alaris Group serves industries requiring specialized RF equipment used to measure, control, process and manage equipment and materials used in a variety of industrial applications. Our products support advanced RF and microwave test and measurement requirements, supplemented by decades of experience in the field of electromagnetic measurement and modelling.

Healthcare

Our products are incorporated into some of the most promising new treatment systems developed by our customers in the healthcare space. There is enormous potential for RF and microwave technology to treat and diagnose conditions, ease pain, image the human body and improve peoples’ lives for the better.